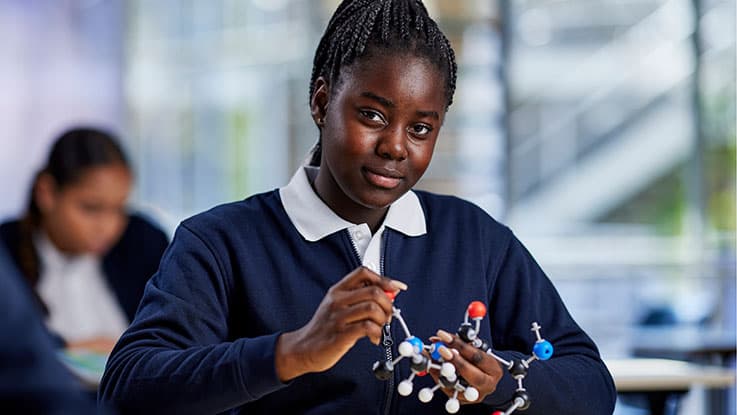

Our learning support and mentoring programs in 90 Australian communities directly help children in need achieve their goals through education.

View all programs

Estimated Tax Saving: $0.00

Estimated Cost to You: $0.00

Check for DGR status and find out what impact your gift will have.

You can check this by using the Australian Business Register.

It’s often easiest to donate online or by phone.

You should keep all records of tax deductible gifts.

Claim your donation when you file your next tax return from 1 July.

Your donation can support children to access help from dedicated and skilled volunteer tutors in our out-of-school Learning Club.