Our finances

Investing for impact

At The Smith Family, we are committed to supporting young Australians to overcome educational inequality caused by poverty. Our investment decisions are aligned with this purpose, guided by evidence and focused on delivering measurable outcomes for the communities we serve.

In the five years to June 2025:

- 74% of donations from our supporters was spent on our community programs

- 26% of our resources invested in vital activities that build our organisational sustainability and success.

However, our funding allocation to community programs is just one measure of effectiveness. Another critical dimension is the positive impact our investment in resources and activities has in supporting our four long-term program outcome measures. We track and report:

Expenditure to administer programs and run the organisation is integral to our sustainability and outcomes.

-

Attendance

Regular school attendance is essential for students to achieve positive educational outcomes.

81.7% is the average attendance for Years 1-10 Learning for Life students in 2024.

-

Advancement

Each year of schooling a child completes leads to better overall life outcomes, and improves their ability to make economic and social contributions to the community.

64.9% of Learning for Life students in Year 10 in 2022 advanced to Year 12 by 2024.

-

Tertiary continuation and completion rate

We measure the proportion of students who complete a qualification in four years.

49% of Learning for Life Tertiary Scholarship students who commenced study in 2020 had completed a qualification by 2024. -

Post school engagement

A key indicator of the success of our approach is the proportion of Learning for Life students who transition successfully from school to further education, training or employment.

84% of students in Year 12 in 2022 were in work and/or study two and a half years after leaving school.

Investing in the ongoing sustainability of The Smith Family

Our goal remains to deepen our impact and grow our reach by building and growing sustainable funding streams that enable investment in lasting social impact.

While spending on community programs will always be our priority, it is also critical to invest in our organisational capabilities and sustainability so we can deliver on our purpose of helping young Australians overcome educational inequality caused by poverty. Investing in our fundraising capabilities, systems, cyber security and people underpins the development and delivery of quality programs, tracking and measurement of outcomes and long-term organisational sustainability.

These critical enablers of impact support our work across more than 780 schools each year, with every dollar invested in fundraising generating $3.35 to sustain and expand our programs.

Long-term educational support

At The Smith Family, we believe that education is the most powerful change agent. Research shows that children can thrive in their education with the right support at the right time. This, in turn, gives them the best opportunity to realise their potential and create their own futures beyond school.

Our long-term educational support for students experiencing disadvantage helps remove the barriers that poverty puts in the way. This support starts early, in the pre-school years, with foundational numeracy and literacy programs to ensure that children are ready to start and flourish at school.

Then, through our Learning for Life program, The Smith Family works collaboratively with children and their families throughout primary and secondary school to deliver positive educational outcomes.

Our Annual Impact Report 2024-25

Previous Annual Reports & financial reports

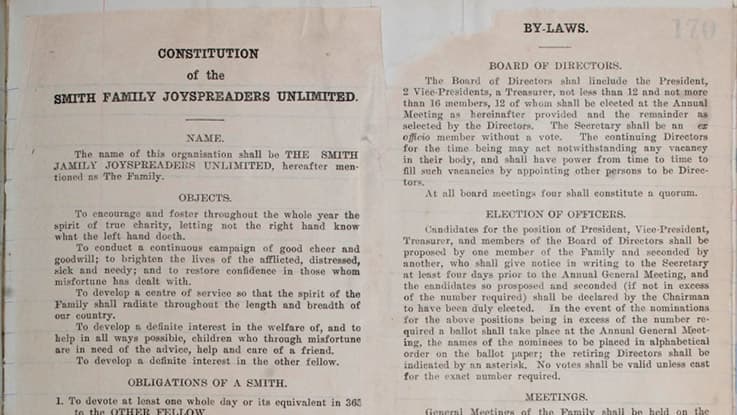

We are governed by our constitution

The Smith Family is a registered charity. We are governed by a constitution and embedded governance structure that enable us to achieve our mission in a way that is consistent with our vision, values, and strategy.

The Smith Family's charitable status

The Smith Family’s status as a Public Benevolent Institution (PBI) was confirmed in July 2005 by the Australian Taxation Office as part of its registration requirements for all non-profit entities, as was the organisation’s status as an Income Tax Exempt Charity and a Deductible Gift Recipient. The organisation enjoys certain other tax concessions and exemptions consistent with its status as a PBA which relate to Goods & Services and Fringe Benefit Taxes.

The Smith Family is registered as required by law in each State and Territory where it raises funds as follows:

Australian Capital Territory

Registration number L19000133 – registration is ongoing subject to continued registration with the ACNC

New South Wales

Registration number CFN 11049 – renewable in 2024

Queensland

Registration number CP 4163 – registration is ongoing subject to meeting certain annual financial reporting requirements

South Australia

Registration number CA 778 – registration is ongoing subject to meeting certain annual financial reporting requirements

Tasmania

Registration number FIA-170 – registration is ongoing

Victoria

Registration number FR 0010290 – registration is ongoing subject to continued registration with the ACNC

Western Australia

Registration number CC 20352 – registration is ongoing subject to continued registration with the ACNC

Smith Family is a company limited by guarantee (ABN 28 000 030 179). The Smith Family’s auditor is Ernst & Young. Legal services are provided by King & Wood Mallesons and banking by Westpac Banking Corporation.

About us

-

Contact us

Our contact details for areas of The Smith Family helping families, students, supporters and others. -

FAQs

Find answers to commonly asked questions across general information, sponsorship and volunteering. -

Our finances

We rely on support from generous donors, sponsors and our corporate partners for the majority of our income. -

Governance

We are committed to ensuring your generous support is used in the best possible way. -

Our history

For one hundred years, The Smith Family has been supporting disadvantaged Australians.