Tax-deductible donations

How to reduce your income tax with donations

Use the charity tax calculator to calculate the tax deduction you could receive by donating to THE SMITH FAMILY

Disclaimer: You may be eligible for a tax deduction for your charitable donation over $2. These figures are based on current ATO resident individual Income Tax rates and do not include the Medicare Levy of 2%. The amounts shown in the charity tax benefit calculator above are a guide only and atotaxcalculator.com.au does not provide legal or tax advice.You should always seek independent financial advice.

Disclaimer: You may be eligible for a tax deduction at tax time for your charitable donation over $2. These figures are based on current ATO resident individual Income Tax rates and do not include the Medicare Levy of 2%. The amounts shown in the charity tax benefit calculator above are a guide only and The Smith Family does not provide legal or tax advice. Calculator created with the Australian Tax Office available tax deduction figures by ATO Tax Calculator. ATO Tax Calculator are not affiliated with the Australian Tax Office and have provided The Smith Family use of the above calculator for general purposes only. You should always consider your personal circumstances and, if necessary, seek independent financial advice before donating.

4 steps to make tax deductible donations

Step 1 – Select a charity that has DGR status

Check for DGR status and find out what impact your gift will have.

You can check this by using the Australian Business Register.

Step 2 – Make your donation

It’s often easiest to donate online or by phone.

Step 3 – Keep your receipt

You should keep all records of tax deductible gifts.

Step 4 – Claim your tax deduction

Claim your donation when you file your next tax return from 1 July.

Gift to donations

FAQs

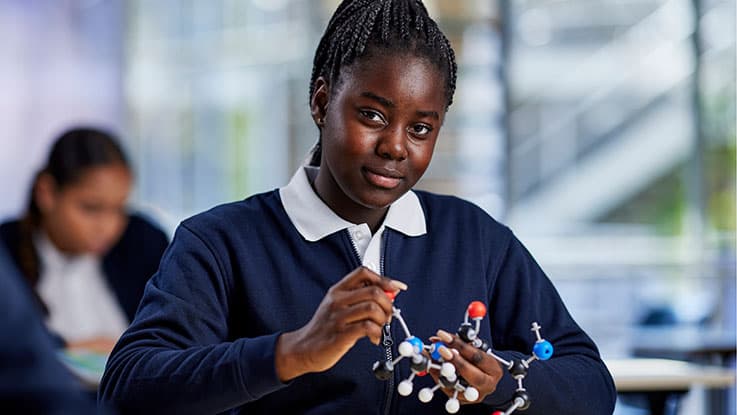

How your donation will help a student

Future Seekers

Learning Clubs

Your donation can support children to access help from dedicated and skilled volunteer tutors in our out-of-school Learning Club.

Growing Careers Project

This article contains general information only. It does not take into account your personal or financial circumstances. You should obtain independent professional advice in relation to your particular circumstances and issues if you need clarification of any matter.